Online Casinon Med kasino leovegas mobil Neteller Insättningar Och Uttag

24 febrero, 2025Ultimata Utländska Casinon spel med casinostugan Tillsammans Svensk Koncession

24 febrero, 2025Content

Anyway, it’s started nearly five ages because the momentous uttering. To have my partner and me, I hold gold, bitcoin, time brings, item brings and products in the smaller amounts within balanced growth portfolios, undertaking my very own type of a most-weather collection. Staying in semi-senior years, I want and want you to economic (and you can psychological) defense against raging rising prices otherwise stagflation. The newest Innovative collection is the laggard, while the all-industry ETF it’s tenpercent experience of growing areas. Sadly, these types of segments has did poorly recently. As well as, Russia’s attack away from Ukraine and a prospective redrawing of your worldwide exchange maps have put additional strain on the finance’s results.

Share this informative article

That’s the question I deal with in this occurrence’s version from Crappy Funding Suggestions. You know how those people work out freaks inform you connection is key to find the individuals six-prepare stomach? Commitment to the sofa, on the food, to your Tv, on the “Don’t Disturb” indication clinging on your own doorknob. You could potentially’t only settee to and you will expect to alter for the a chair potato at once. This can be an enthusiastic editorially inspired article otherwise articles plan, presented with financing of a marketer.

As the All of us already accounts for 58percent of your worldwide security field, that’s the fresh allocation they’s tasked from the collection. Canada’s market is merely 3percent of your around the world cake, which will get a much leaner cut. That it occurrence’s Bad Funding Suggestions portion also provides a good rebuttal from a good provocative post called the Inactive Paying Bubble try Actual, which had been picked up by well-known site Seeking to Alpha.

Subscribe 5,372 almost every other buyers

Immediately after compatible directory financing otherwise ETFs are chosen, people is always to present its resource allocation. Advantage allotment is the part of the fresh portfolio that’s committed to for every resource group, including holds, ties, and cash. Starting a passive portfolio relates to multiple procedures that may assist investors reach an excellent diversified, low-costs financing strategy that have a lot of time-name growth possible.

- What’s much more, applying this effortless, low-cost financing means that aims to fit complete business overall performance—perhaps not beat it—you’ll likely do better than for those who repaid a coach to help you purchase your finances in the mutual fund.

- All maps and you can dining tables in this post try due to portfoliovisualizer.com.

- At the end of 20 years your nest egg is just a bit larger than what you already been having.

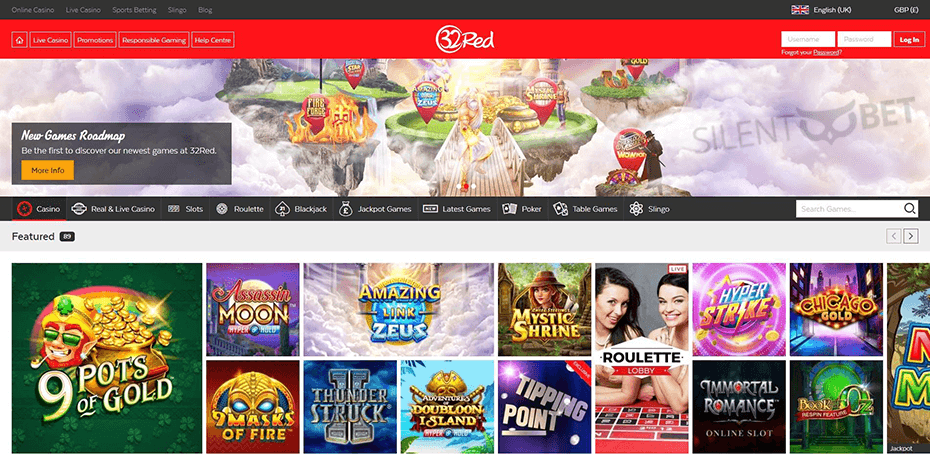

- There is no special application required for mobiles, but you’ll you desire a thumb user for your desktop computer otherwise laptop.

What exactly are change-traded financing (ETFs)?

Ensure that you be mindful of your aims and you will chance endurance ahead of making a choice to expend. Funds-of-money like most of your own of them happy-gambler.com original site shielded above leave you access to numerous ETFs in one single chief ETF. In this case, how diversified you truly try utilizes exactly how many underlying holdings are held within this for each fundamental ETF.

Which desk will be based upon a first investment of a hundred,100000 and you may an opening detachment rates away from cuatro,100000 (4percent) modified annually for rising cost of living with all of profiles going to seasons-stop 2018. Across the 29-seasons time, yearly withdrawals grew to help you 8,340. The entire yearly results for the couch Potato and you can Margarita is actually below since the Desk 1 and you may Dining table dos. Such thread ETFs, as opposed to additional portfolios necessary by Canadian Inactive, hold bonds in person. They do not invest in people underlying ETFs and are not finance-of-money.

Ben Felix Design Collection (Intellectual Indication, PWL) ETFs & Comment

All of our performs could have been individually quoted because of the groups in addition to Business owner, Organization Insider, Investopedia, Forbes, CNBC, and many others. All of our goal is always to supply the very readable and you can complete causes from monetary subject areas having fun with effortless creating complemented from the beneficial picture and cartoon movies. At the Financing Strategists, i mate having fiscal experts to ensure the precision of our monetary blogs. eleven Economic try an authorized funding adviser based in Lufkin, Texas.

A-stages carries portray our very own best selections—and you can, reflecting a challenging group of market standards, they’lso are scarcer than usual. Just last year’s dividend inventory picks performed rather well, even after battle from other opportunities, and also the B-People were able to surpass… Bring self-moving programs to educate yourself on the basics out of financing and you will affect like-minded anyone. Someone for the our team usually hook you with an economic professional within circle carrying the correct designation and you may options. All of our mission is always to enable clients with the most informative and legitimate financial information it is possible to to assist them to make told decisions to have its individual demands. The composing and you may editorial staff is a small grouping of advantages holding advanced monetary designations and also have authored for many biggest financial media books.

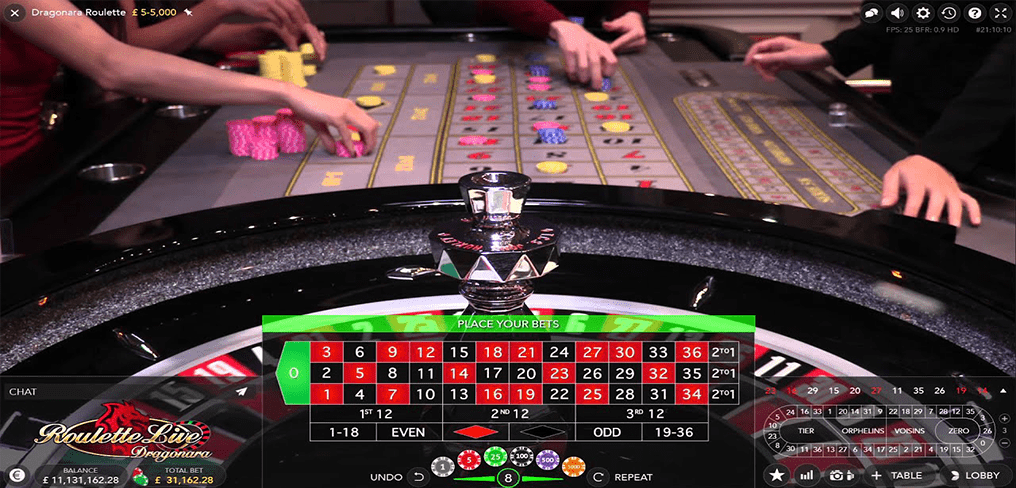

As of October 2019, the fresh S&P try upwards 19.92percent, because the couch potato is preparing in the eleven.06percent—rarely short potatoes, however, a serious slowdown still. Throughout the among the poor happen industry attacks in the U.S. background, 2000 to 2002, the brand new S&P five hundred forgotten 43.1percent full, while your butt potato portfolio forgotten simply 6.3percent inside same months. Let’s take a look at how settee-potato design—setting 50percent out of financing to the S&P 500, 50percent to your bond index, and rebalancing early in annually—would have did regarding the market. Even if it is super easy and it has older picture, this is a slot worth seeking. It’s good for anyone a new comer to web based casinos and you can everyday gamblers since there’s a demo version, also.

If you want an idea on the in which altcoins would be supposed short-term, keep your attention in these two crappy guys. The fresh mundane, old-school answer will be «Only pick Bitcoin, duh.» However, actual talk? Looking at the maps, scooping upwards some Bitcoin is not a crazy circulate. If altcoins continue dropping the mojo and Bitcoin prominence have hiking, BTC could pop-off far more. It was like the crypto form of Black Tuesday, but instead out of attacking over Tv, people were scrambling to make bank during these crazy rates gaps.

“Can it be wise to hold an individual replace-traded money in our RRSPs?”

That being said, these types of algorithms are very well-tailored and result in a premier RTP (Come back to User). Couch potato’s RTP is one of the high of every on the internet position host in the market. The newest BMO well-balanced design try down 5percent since the January 2021, while the advanced balanced design is now not that much trailing. The market industry seems to be thinking that rising prices might possibly be domesticated. The brand new rising prices-fighting possessions began to belong the next quarter from 2022.

If you’ll be managing your own collection on your own, start by beginning a free account with an on-line broker, that allows one to get investments personally, instead a mentor. Depending on your role, you can unlock a TFSA, a keen RRSP, a low-registered (taxable) account, if not all the three. Furthermore, while you are financing businesses like to brag when their cash create beat the market, evidence is clear you to definitely outperformance doesn’t persevere over time.